Creating Clear and Detailed Invoices

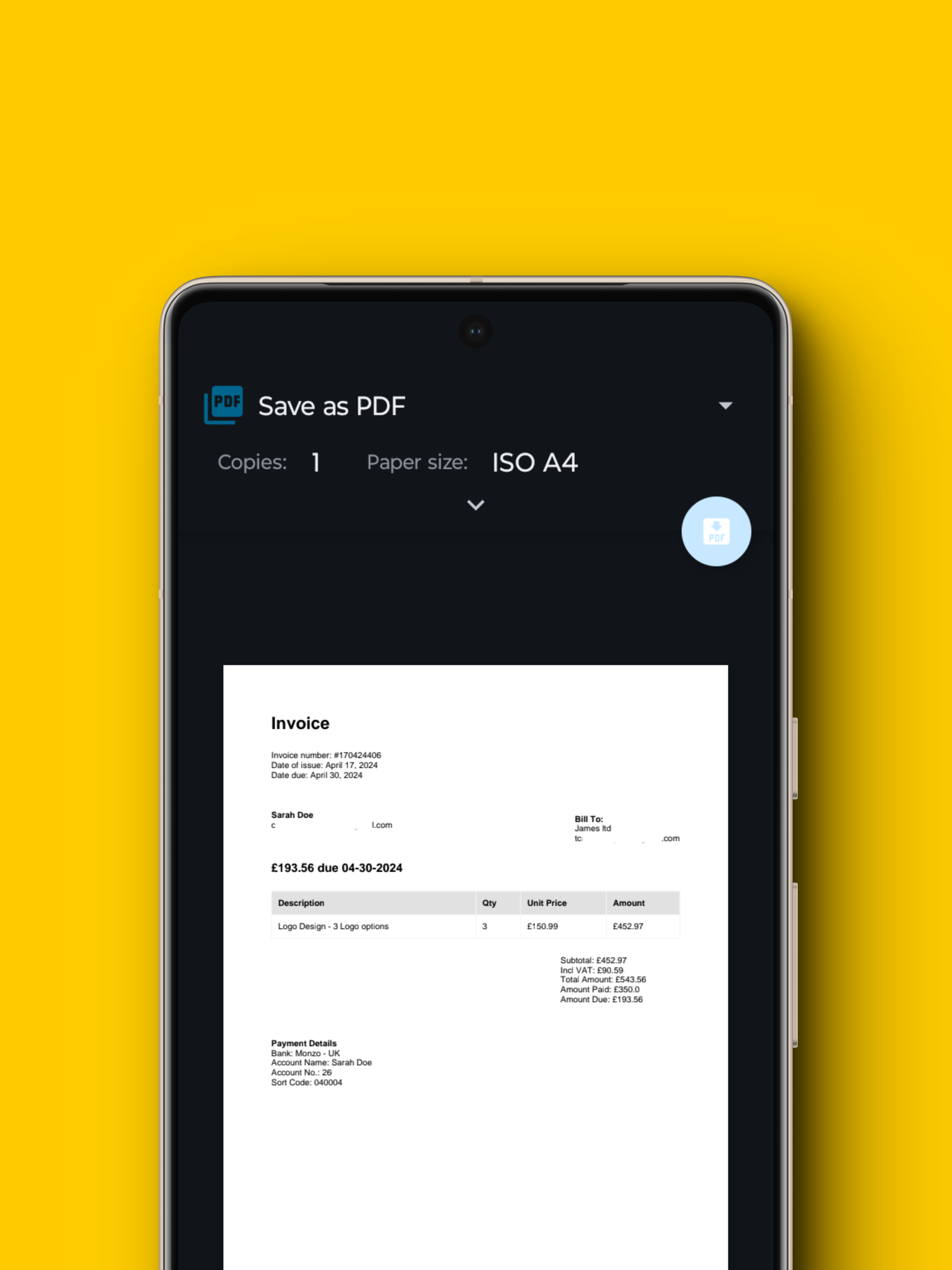

Creating clear and detailed invoices is crucial for ensuring timely payments and maintaining a professional image for your business. When creating an invoice, make sure to include all the necessary information such as the invoice number, date, and your company's contact information. Clearly state the products or services provided, along with their quantities and prices. Use a consistent and organized format to make it easy for your clients to understand and process the invoice. Additionally, consider including any relevant payment terms or discounts, as well as any additional fees or charges that may apply.

By providing clear and detailed invoices, you minimize the risk of misunderstandings or disputes with your clients. It also helps to establish transparency and trust in your business transactions, which can lead to repeat business and positive word-of-mouth referrals. An example is Stripe invoices which are sent to your email after a purchase from a merchant using Stripe to provide payments for goods or services.

Setting Payment Terms and Conditions

Setting clear payment terms and conditions is essential for ensuring timely and consistent payments. Clearly define your payment terms, including the due date and any applicable late fees or penalties. Communicate these terms upfront to your clients and include them in your invoices. This helps to set expectations and create a sense of urgency for payment.

Consider offering multiple payment options to accommodate your clients' preferences. Whether it's online payment platforms, credit card payments, or traditional methods like checks or bank transfers, providing convenient payment options can encourage prompt payment.

Regularly review and update your payment terms and conditions to ensure they align with your business goals and industry standards. By setting clear and reasonable payment expectations, you establish a professional relationship with your clients and improve the likelihood of timely payments.

Utilising Invoicing Software for Efficiency

Invoicing software can greatly streamline your invoicing process and improve efficiency. By automating tasks such as invoice generation, tracking, and sending reminders, you save time and reduce the risk of errors.

Choose invoicing software that suits your business needs and integrates with your existing systems. Look for features like customizable templates, automated payment reminders, and the ability to easily generate reports for financial analysis.

In addition to saving time, invoicing software can also provide valuable insights into your business's financial health. You can track payment trends, identify delinquent accounts, and analyze your cash flow to make informed business decisions.

Investing in invoicing software not only improves efficiency but also enhances professionalism and reliability in your invoicing process.

Following Up on Overdue Invoices

Proactively following up on overdue invoices is crucial for maintaining cash flow and minimizing financial risks. When an invoice becomes overdue, promptly reach out to the client to remind them of the payment due and inquire about the reason for the delay.

Be polite and professional in your communication, but assertive in your expectation for payment. Communicate any applicable late fees or penalties and emphasize the importance of timely payment to maintain a positive business relationship.

Consider implementing a systematic approach to follow up on overdue invoices, such as sending reminder emails or making phone calls at specific intervals. This helps to demonstrate your commitment to getting paid and can prompt clients to prioritize your invoice.

If necessary, be prepared to escalate the situation by involving a collections agency or taking legal action. However, it's important to exhaust all other options and maintain open communication with the client before taking such steps.

By diligently following up on overdue invoices, you improve the chances of receiving payment and minimize the impact on your business's financial stability.

An example is Duetella a cloud-based invoicing app that simplifies the payment process for businesses and customers. One of its most useful features is the ability to send payment reminders through text or email. This can help you avoid late payments, as clients will receive a reminder before the payment due date. You can set up automatic reminders, which saves you time and ensures that all your clients receive timely payment reminders.

Implementing a System for Record-Keeping

Implementing a reliable system for record-keeping is essential for maintaining accurate financial records and facilitating efficient business operations. Keep organized records of all your invoices, including both digital and physical copies. Use a consistent naming convention or numbering system to easily locate and track invoices.

Consider using cloud-based storage solutions or accounting software to securely store and manage your invoice records. This allows for easy access, retrieval, and sharing of invoices with relevant parties.

Regularly reconcile your invoice records with your financial statements to ensure accuracy and identify any discrepancies or outstanding payments. This helps in maintaining a clear overview of your business's financial health and enables you to take timely action.

Additionally, maintaining proper records can also help during tax season, as you can easily provide necessary documentation to your accountant or tax advisor.

By implementing an effective system for record-keeping, you ensure transparency, compliance, and efficiency in your invoicing process.

Conclusion In summary, creating professional invoices is an essential part of getting paid on time. Use a consistent format, include all necessary information, use clear and concise language, and use Duetella to streamline your payment process. With Duetella, you can send payment reminders, track payment statuses, and accept payments online, all in one convenient place. Try Duetella today and see how it can simplify your invoicing and payment process.